BOM: 500032 – Bajaj Hindusthan Sugar Limited is a sugar manufacturer in India, Asia’s Number 1 and World’s Number 4 combined sugar company. On November 23, 1931, Bajaj Hindusthan (BHL) incorporated the name –The Hindusthan Sugar Mills on the enterprise of Jamnalal Bajaj – a businessman, intimate follower, and adopted son of Mahatma Gandhi. Bajaj Hindusthan (BHL), a share of the Bajaj Group, is India’s Number One sugar and ethanol manufacturing company, headquartered in Mumbai (Maharashtra), India.

Across 14 sites in the north Indian State of Uttar Pradesh (UP), BHSL has a combined sugarcane crushing capacity of 136,000 tonnes crushed per day (TCD) and an alcohol refinement capacity of 800 kiloliters per day (KLD). It is a member of the Bajaj Group, and the company is headquartered in Mumbai. The company is a front-runner in the Asian and Indian sugar industry and one of India’s largest producers of green fuel ethanol.

An area rich in sugar cane, the site selected for the first plant was at Gola Gokarannath in the district Lakhimpur Kheri in the Terai region of Uttar Pradesh (UP).

Table of Contents

The Chairman of Bajaj Hindusthan Sugar Ltd is Kushagra Bajaj

Bajaj Hindusthan Sugar Ltd. involves in the production and market of sugar and industrial alcohol. It operates through the following segments: Sugar, Distillery, Power, and Others. It offers sugar manufacturing processes, by-products, bio-compost/bio-manure, quality standards, sugar quality, and procurement processes. The company was initiated by Jamnalal Bajaj on November 23, 1931, and is headquartered in Noida, India.

Is Bajaj Hindusthan Sugar Ltd a good quality company?

The past ten year’s financial track record analysis by Moneyworks4me indicates that Bajaj Hindusthan Sugar Ltd is an average-quality company.

2. Is Bajaj Hindusthan Sugar Ltd undervalued or overvalued?

Compared to its past, the critical valuation ratios of Bajaj Hindusthan Sugar Ltd’s current seem to suggest it is in the Fair zone.

3. Is Bajaj Hindusthan Sugar Ltd a good buy now?

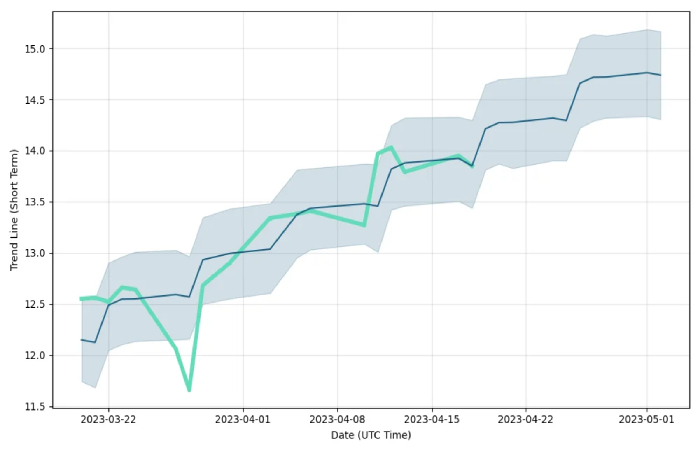

The Price Trend analysis by MoneyWorks4Me indicates it is Semi Strong which suggests that the price of Bajaj Hindusthan Sugar Ltd is likely to Rise-somewhat in the short term. However, please check the rating on Quality and Valuation before investing.

Bajaj Hindusthan Sugar Stock Forecast, “500032” Share Price Prediction

Historical index on the Bombay Stock Exchange: According to the live Forecast Scheme, Bajaj Hindusthan Sugar Ltd. stock is an excellent lasting (1-year) investment. “BAJAJHIND” stock predictions are updated every 5 minutes with the latest conversation prices by keen technical market analysis.

Predict upcoming values with technical analysis for a wide selection of stocks like Bajaj Hindusthan Sugar Ltd. (BAJAJHIND). If you watch for stocks with good returns, Bajaj Hindusthan Sugar Ltd. can be a gainful investment decision. Bajaj Hindusthan Sugar Ltd. estimate is equal to 14.450 INR on 2023-04-20. Based on forecasts, a long-term increase is predictable. The “BAJAJHIND” stock price forecast for 2028-04-14 is 30.460 INR. With a 5-year investment, the revenue will likely be around +110.79%. Your current $100 savings may be up to $210.79 in 2028.

Bajaj Hindusthan Sugar rises on acquiring 98.01% stake in Phenil Sugars – March 24, 2023

- Bajaj Hindusthan Sugar is trading at Rs. 12.69, up by 0.03 points or 0.24% from its previous closing of Rs. 12.66 on the BSE.

- The scrip opened at Rs. 12.92 and has touched a high and low of Rs. 13.19 and Rs. 12.63, respectively. So far, 619510 shares have been dealt on the pledge.

- On 17-Aug-2022, the BSE group, ‘A’ stock of face value Rs. 1, affected a 52-week high of Rs. 22.58 on 22-Apr-2022 and a 52-week low of Rs. 8.37.

- Last week’s peek and low of the scrip stood at Rs. 13.19 and Rs. 12.45, respectively. The present marketplace cap of the company is Rs. 1617.14 crores.

- The company organizers’ holding stood at 24.95%, while Institutions and Non-Institutions had 16.87% and 58.17%, respectively.

- Bajaj Hindusthan Sugar (BHSL) has acquired 98.01% shareholding (post-conversion) of Phenil Sugars (PSL) by way of conversion of existing preference shares into equity shares. There is a substantial appreciation in the value of assets (mainly land) of PSL’s plants at Basti and Govindnagar. Accordingly, it recommend to take control over PSL to realize the investments complete by BHSL in PSL. After taking control of PSL, BHSL may take necessary steps to realize the amount by appropriately selling the assets of PSL and putting the assets to proper usage.

- Bajaj Hindusthan Sugar, a part of the ‘Bajaj Group,’ is India’s Number One sugar and ethanol manufacturing company, headquartered in Mumbai (Maharashtra), India.

Bajaj Hindusthan Sugar Ltd Frequently Asked Questions

What is Bajaj Hindusthan Sugar Ltd(BOM:500032)’s stock price today?

The current price of BOM:500032 is ₹14.47. The 52-week high of BOM:500032 is ₹20.16, and 52 weeks low is ₹8.37.

What is the TTM revenue of Bajaj Hindusthan Sugar?

The TTM revenue is Trailing Twelve Months’ sales. The TTM revenue/sales of Bajaj Hindusthan Sug is ₹ 5,883 ( Cr.)

What is the 52-week high and low of Bajaj Hindusthan Sugar?

The 52-week high of Bajaj Hindusthan Sug is ₹ 20.16, and the 52-week low is ₹ 8.37.

Does Bajaj Hindusthan Sugar Ltd(BOM:500032) pay dividends? If so, how much?

Bajaj Hindusthan Sugar Ltd(BOM:500032) does not pay dividend.